If you're serving on a condo board in Ridgewood, Queens, you've probably had this conversation: "Do we really need to hire a property management company? Can't we just handle this ourselves and save the money?"

It's a fair question. Management fees can look like just another line item on an already tight budget. But here's what most board members discover after a year or two of self-management: the actual costs of going it alone: hidden vendor markups, compliance penalties, accounting errors, and burnout: often exceed what professional property management in Ridgewood Queens would have cost in the first place.

Let's break down exactly how professional Queens condo management services pay for themselves, and why more Ridgewood boards are making the switch in 2026.

How Does Combined Buying Power Cut Your Vendor Costs?

One of the most immediate ways professional management saves money is through vendor relationships. When your 20-unit condo building needs a new boiler or roof repairs, you're essentially a small fish negotiating with contractors who prioritize their larger clients.

Property management companies flip that dynamic entirely.

A firm managing 50+ buildings across Queens has serious negotiating leverage. They're bringing plumbers, electricians, roofers, and HVAC specialists consistent volume work throughout the year. That translates to:

- 10-25% lower rates on routine maintenance and emergency repairs compared to retail pricing

- Priority scheduling when something breaks (because vendors want to keep that relationship strong)

- Pre-vetted, licensed professionals who won't disappear mid-project or deliver subpar work

Here's a real-world example: A 30-unit Ridgewood condo needed facade work estimated at $85,000 from a contractor they found independently. When they brought in professional management, the same scope of work through the management company's network came in at $68,000: a $17,000 difference that more than covered two years of management fees.

This combined buying power extends beyond major projects:

- Annual landscaping contracts

- Snow removal services

- Pest control agreements

- Insurance policies (some management firms negotiate group rates)

- Cleaning and janitorial services

The savings compound quickly when you're no longer paying retail rates across every service your building requires.

What Compliance Fines Can Professional Management Help You Avoid?

NYC's regulatory environment for residential buildings gets more complex every year. For volunteer board members juggling full-time jobs, keeping track of deadlines for Local Law 11 (facade inspections), Local Law 87 (energy audits), and elevator certifications is a recipe for missed deadlines and costly violations.

The price of non-compliance isn't theoretical. Buildings that miss Local Law 11 filing deadlines face penalties starting at $1,000 per month and escalating from there. Local Law 97 fines begin in 2026 for buildings that exceed carbon emission caps, with penalties reaching $268 per ton of excess emissions.

Professional management companies maintain compliance calendars tracking every required filing, inspection, and certification for your building. They coordinate:

- Required facade inspections every five years

- Elevator inspections and annual certifications

- Boiler inspections and annual filings

- DOB violations and ECB hearings

- Energy audits under Local Law 87

- Gas piping inspections under Local Law 152

Beyond avoiding fines, staying compliant protects your building's value. Prospective buyers' attorneys review a building's violation history during due diligence. A clean DOB record signals well-managed property: open violations raise red flags that can derail sales or reduce unit values.

The cost of professional management suddenly looks different when you frame it as insurance against five-figure penalties and property devaluation.

How Does Transparent Bookkeeping Save Money Long-Term?

Here's where many self-managed condos run into trouble: financial record-keeping. What starts as a simple spreadsheet maintained by a volunteer treasurer quickly becomes an accounting mess when that person moves, gets overwhelmed, or simply doesn't have the expertise to properly categorize expenses and maintain audit trails.

The consequences can be expensive:

- Tax filing errors that trigger IRS penalties

- Missing documentation when owners request financial statements for refinancing

- Budget shortfalls from poor expense tracking

- Inability to identify spending patterns or cost-saving opportunities

- Disputes over special assessments due to unclear financial records

Professional property management in Ridgewood Queens provides systematic financial administration:

- Monthly financial statements with clear categorization of all income and expenses

- Transparent tracking of vendor payments (no hidden markup on contractor invoices)

- Reserve fund management with clear documentation of contributions and withdrawals

- Annual budget preparation based on actual historical spending patterns

- Tax-ready financial records that simplify 1120-H filing requirements

Critically, reputable management companies operate with no hidden fees. They don't mark up vendor invoices or take kickbacks from contractors: a practice that can cost buildings thousands annually. Instead, their fees are straightforward: a fixed percentage of collected revenue or a flat monthly rate, with all pass-through expenses clearly documented.

This transparency extends to record-keeping. With professional management, any board member can access detailed financial reports 24/7 through online portals, eliminating the "black box" problem that often develops with self-management when only one or two people control the books.

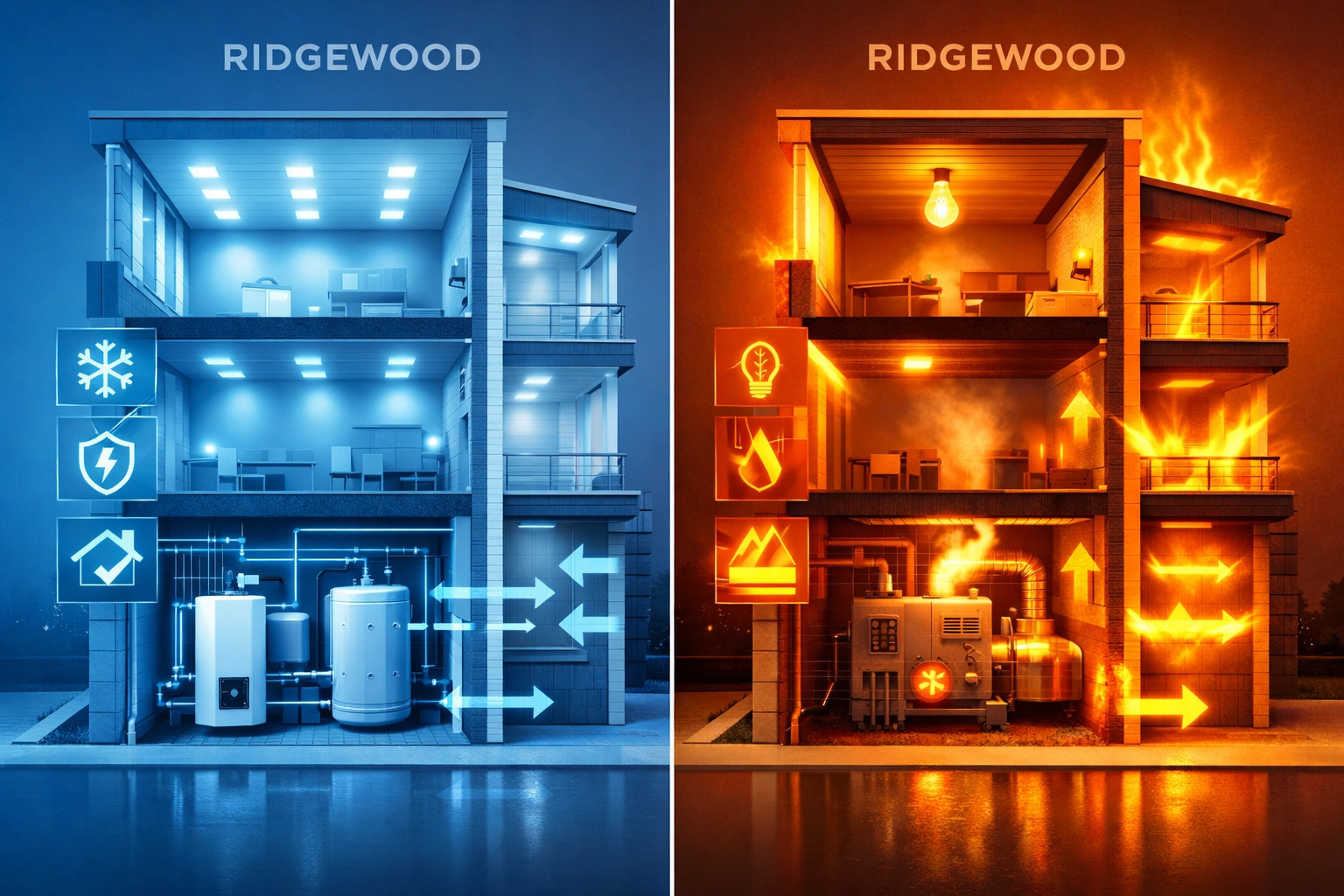

Can Energy Efficiency Audits Actually Reduce Operating Costs?

Ridgewood's building stock includes many pre-war structures with aging mechanical systems. These buildings often hemorrhage money through inefficient heating systems, poor insulation, and outdated lighting: expenses that just get absorbed into "that's what it costs to run the building."

Professional management companies increasingly include energy efficiency assessments as part of their service. These audits identify specific improvements that deliver measurable ROI:

- LED lighting retrofits in common areas (typically paying for themselves within 18-24 months through reduced electricity costs)

- Boiler efficiency improvements or replacements (older boilers can waste 20-30% of fuel consumption)

- Building envelope improvements that reduce heating and cooling demands

- Smart thermostat installations for common area climate control

- Water-saving fixtures that reduce water and sewer costs

For many buildings, these aren't optional nice-to-haves anymore. Local Law 87 requires energy audits every 10 years for buildings over 25,000 square feet. Local Law 97's carbon emission caps are pushing buildings toward efficiency upgrades whether they planned for them or not.

A property management company familiar with Queens condo management services can guide boards through available incentive programs: Con Edison rebates, NYSERDA financing, and property tax abatements for qualified improvements: that reduce upfront costs and accelerate payback periods.

One Ridgewood condo reduced their annual heating costs by $12,000 after implementing recommendations from an energy audit coordinated by their management company. Those savings continue year after year, while the audit itself was a one-time expense partially offset by utility rebates.

How Do You Calculate the True Cost Comparison?

When evaluating whether professional management makes financial sense, boards need to look beyond the management fee itself. Create a comprehensive comparison:

Self-Management Hidden Costs:

- Retail vendor pricing (vs. negotiated rates)

- Time cost of volunteer board members handling day-to-day management

- Potential compliance penalties from missed deadlines

- Accounting software and financial management tools

- Legal fees for handling tenant disputes without experienced guidance

- Higher insurance premiums (some carriers offer discounts for professionally managed buildings)

- Lost opportunities to optimize spending and identify cost savings

Professional Management True Cost:

- Management fee (typically 5-10% of collected revenue for condos)

- Minus vendor savings from negotiated rates

- Minus avoided compliance penalties

- Minus time saved by board members

- Plus improved financial transparency and decision-making

For most Ridgewood condos, the math works out favorably once you account for all factors. A building with $300,000 in annual common charges might pay $18,000-$27,000 for management but save $15,000+ through better vendor pricing alone, before factoring in compliance protection and financial systems.

What Should Ridgewood Boards Look for in a Management Company?

Not all property management firms deliver the cost savings outlined above. When evaluating Queens condo management services, prioritize these qualities:

Full Transparency: Insist on management agreements that prohibit contractor kickbacks and require detailed documentation of all spending. Your management company should provide clear monthly financial statements and make all records easily accessible.

24/7 Availability: Boilers don't wait for business hours to fail. Look for firms offering round-the-clock emergency response, not just an answering service that takes messages for callback the next day.

No Hidden Fees: The contract should clearly specify what's included in the base management fee and what constitutes additional charges. Watch for companies that nickel-and-dime boards with separate fees for routine services like lease processing or violation management.

Local Market Knowledge: Ridgewood sits at the Queens-Brooklyn border with a unique housing mix of condos, co-ops, and rental buildings. Choose a firm with specific experience managing properties in Queens and Brooklyn who understand the local market dynamics and vendor ecosystem.

Proven Vendor Network: Ask prospective management companies about their contractor relationships. How many buildings do they manage? How do they vet vendors? Can they provide examples of cost savings they've delivered for similar properties?

The goal isn't just hiring any management company: it's finding a partner who genuinely reduces your operating costs while improving building operations. The right firm pays for itself through better pricing, smarter budgeting, and protection against expensive mistakes.

For Ridgewood condo boards stretched thin trying to manage buildings themselves, professional property management isn't an expense: it's an investment that delivers measurable returns through reduced costs, protected property values, and peace of mind that compliance requirements won't slip through the cracks.

If your board is spending meetings arguing about vendor quotes, worrying about upcoming inspection deadlines, or trying to make sense of disorganized financial records, it might be time to explore what professional management can do for your building's bottom line.